If you are searching for Sovereign Gold Bond Returns Calculator, look no further. In this article, I will share a calculator which will not only give you Sovereign Gold Bond returns but also the returns on other gold forms.

We will be comparing returns from Physical Gold, Digital Gold (bought from Paytm or any similar website), Gold ETF and Sovereign Gold Bond (SGB bought from RBI). We have taken a 5-year period for the calculations. 5 year holding period is chosen just because of the holding period after which you can sell back SGB to RBI.

Quick Tip – For those of you in hurry, download the excel template for SGB Return Calculator available at the end of the article. You will just have to fill in your numbers and find out which gold form gives the maximum return. But if you are the type who wants to understand how calculations are done, read on.

Let us first start with basic understanding of different gold types which we can purchase.

What are the different forms of Gold?

You can buy gold mainly in 4 forms – Physical, Digital, ETF and SGB. Let us quickly understand their salient features before going to returns-related calculations.

- Physical Gold – This is usually purchased from jewelers and is in the form of gold coins, jewelry or pure gold bars. Ease of buying and selling is an advantage but the downside is the added charges in the form of making charges, GST, locker charges etc.

- Digital Gold – This can be purchased online in digital form. After purchase, if you wish, you can get it converted into physical gold as well. Paytm is one of the many sellers who sell Digital Gold. The best advantage is that you can buy in any denomination starting as low as rupees 1. Disadvantages are the commission charges to be paid (approx 3% in the form of buy and sell price difference), GST paid (at 3%), storage charges (0.04%pa of gold holding) and max holding tenure of 5 years (after which you have to either sell or convert to gold coin)

- ETF – These are traded on an exchange similar to any other stock. You can buy and sell Gold ETF (like SBI Gold ETF, Nippon Gold ETF, HDFC Gold ETF etc) any time basis the market price. Ease of buying and selling is the main advantage here.

- SGB – These are issued by the Reserve Bank of India (RBI) in various slots. Advantages are that these are fully secured bonds guaranteed by the Government of India, can be purchased at a discounted rate as compared to market rate (RBI gives 50/- discount if purchased online), you don’t have to pay any additional charges like making, GST, locker etc, are tax-free (if held for 8 years) and it gives you additional interest every year. Disadvantages are that you can buy only on specific dates and cannot sell to RBI before 5 years.

Now that we understand the basics of the 4 options to buy gold in India, let us see which gold form gives maximum returns. Is it better to buy Digital Gold or ETF? Or should I invest in ETF vs SGB?

Which Gold Form gives the highest return?

Investment Cost

Let us first calculate the Investment cost – total amount you will have to pay to buy gold.

Note – I had purchased a SGB in 2017 at the price of 2780/- which was at 50/- discount to market price. Hence, taking that as the purchase price for SGB and 2780 + 50 = 2830/- as the purchase price for all other forms of gold.

Let us assume that we have invested 1L rupees in each of the 4 instruments (physical, digital, etf, sgb).

Let us understand the extra costs we have to bear over and above this 1L investment:

- Physical Gold -> GST of 3%, making charges (between 10-25%, assume 12%), GST on making charges (let’s assume 3% again), locker charges (assume 2000/- pa)

- Digital Gold -> GST of 3%

- ETF -> Expense ratio charged every year (assume 0.5% pa)

- SGB -> No extra cost involved. In fact, we get 50/- discount for online purchases. Hence, the rate on SGB is mentioned as 2780/- instead of 2830/-

Basis all this, following will be the final cost price

Returns after 5 years

Let us now calculate the amount we will get on selling after 5 years. Assume that gold price has appreciated at 10% pa and after 5 years the price is 4,558/-.

Let us first look at the deductions which will happen at the time of selling

- Physical Gold => Some commission will be cut in the form of arbitrary charges etc – assuming it is 1%

- Digital Gold => Buying-Selling commission spread (assume 3% – image shows Paytm Digital gold buying price is 4841/- and selling price is 4696/- and the difference among both is around 3%)

- ETF => no deduction (we have already covered the spread in Investment Section Image 2)

- SGB =>

- Will get interest at 2.5% pa on the purchase price (1L in our case)

- Tax will be deducted on this interest given. Assuming tax is deducted at 30%

Basis this, below is the amount we will get back after 5 years

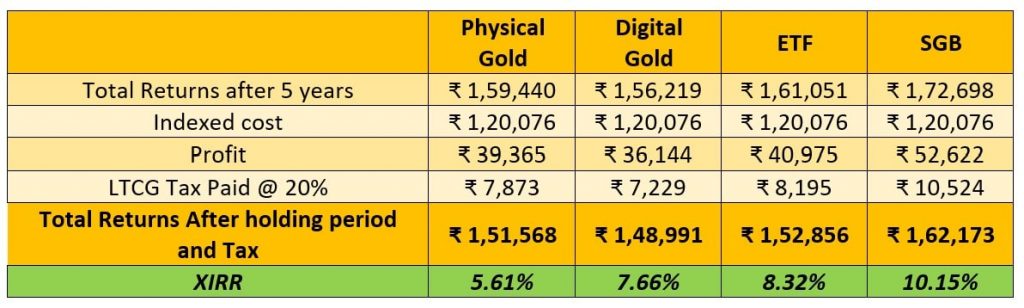

These returns are after 5 years. So, there will also be LTCG applicable to them. After taking indexed cost (Source – Tax Guru) and deducting 20% LTCG on profits, the following are the final returns and the XIRR for each of the gold options.

This is assuming a scenario where gold prices have risen about 10% in the last 5 years. A quick look at historical Gold returns in last few years shows that average rise is higher than 10%.

TIP => After 5 years, it is better to redeem SGB and exit when the market condition is good and you are getting good profits. Holding it for entire 8 years may not only impact your IRR (it dips as # of years increase – from 10.15% to 9.7%) but also risk your returns in case gold price crash.

Sovereign Gold Bond Returns Calculator

How to use Sovereign Gold Bond Returns Calculator

Using our SGB Return Calculator is pretty simple. You just have to populate some data in the cells highlighted in Blue color. Basis that, you will automatically see XIRR for Physical Gold, Digital Gold, ETF and SGB.

Following data have to be entered:

While most of the above cells are self explanatory, following points should be remembered:

- Selling Price of Gold => You can either enter the selling price or just enter the assumed hike in gold prices per year

- Duration held => Do not enter any value in this cell

- Indexation Value => Refer to columns G and H to get the corresponding values for purchase and selling year. You may add future index values to it.

Below is the excel template. Play around by putting your numbers to see the XIRR.

Conclusion

Among the four types of gold options available, SGB is a clear winner in almost all scenarios. Hence, I will recommend everyone to invest in it if they can hold on for at least 5 years.

Hope you liked this article and find the SGB Return Calculator useful. Please feel free to share your feedback and comments.

I also offer a financial consulting and can help you achieve your financial goals with proper planning. You can schedule a free consultation call to discuss your concerns and we can take it from there.

Liked this article? Join my Whatsapp group to be part of our community!

Other articles worth reading!

Also read – 11 New Ways to Earn Extra Income even with a Full-TimeAlso read – Why NOT to rely on Office/Personal Health Insurance for Covid-19

Another interesting article – Visit this snow valley in India to get feel of Switzerland!

Feel free to share this article by clicking on the below icons…