Most of the people buy term insurance only on the basis of Claim Settlement Ratio. They think that higher the claim settlement ratio, higher the chances of their claim getting approved. And companies take advantage of this by showcasing their high claim settlement ratio and selling their policies at higher price. However, buying Term Insurance on the basis of Claim Settlement Ratio is wrong. In this article, I will explain why Claim Settlement Ratio is not the right way to buy Term Insurance and what factors should you consider while buying Term Insurance.

What is Claim Settlement Ratio

First up, let us understand what Claim Settlement Ratio means.

In simple terms, Claim Settlement Ratio explains how many claims the company has received and out of those, how many it has settled.

So for example, a company receives 100 claims and settles 98 claims out of those. This means the company has a claim settlement ratio (CSR) of 98%.

Naturally higher CSR ratio means more claims being settled and less being rejected. And normally a CSR of 98% is considered very good.

So what is wrong with buying Term Insurance on the basis of Claim Settlement Ratio?

There are many problems in relying only on Claim Settlement Ratio to buy Term Insurance.

First of all, CSR is a combined ratio for all the claims the company receives. It is not a ratio restricted only to Term Insurance. Critical Illness related Insurance, Group Insurance for company, Endowment/ULIP policy related claims, Fire Insurance etc are also part of CSR.

Let us understand this with an example. Suppose out of 100 claims, a company receives 98 Endowment Insurance claims and 2 Term Insurance claims. Even if the company rejects both the term insurance claims, its CSR will still be 98%. And this is where the problem lies. Data will not show 100% rejection of term insurance. It will only show 98% claim settlement ratio.

Second problem with CSR is that it does not give details about the Sum Assured of policies for which Term Insurance is approved or rejected. As a result, it is very much possible that company will approve low value insurances while rejecting high value insurances and still maintain high Claim Settlement Ratio.

For example, let us assume company gets 95 endowment insurance (with sum assured upto 10L) and 5 Term Insurance (3 term insurance of 50L and 2 term insurance of 1 Cr). Even if company approves all the endowment insurance and 3 term insurance of 50L sum assured but rejects the 2 term insurance of 1 Cr, it will maintain a CSR of 98%. However, that means most people having 1 Cr or higher premiums will suffer.

Related Read => Avoid these Mistakes While Buying Term Insurance

So what is the solution

This is where Insurance Regulator IRDA became a knight in the shining armor and came to the rescue of general public. It passed an act forcing all insurance companies to mandatorily settle any Term Insurance claims older than 3 years.

As per section 45 of Insurance Regulator Act 2015, all Term Insurance policies older than 3 years will have to be mandatorily passed by the insurance companies. They cannot reject the policies on any ground. Insurance company have 3 years to dig up all the information they can and do all the background checks they want to do. If they find any discrepancy in 3 years, they can either increase the premium or reject the insurance policy while not refunding the premiums. But after 3 years, insurance company cannot reject the claim saying that the details were wrong or hidden.

With this in place, the concerns we saw about Claim Settlement Ratio disappear automatically. All term insurance policies will be approved after 3 years no matter what the amount. And as a result, you no longer have to worry about finding the policy with highest CSR and paying high premiums for it. You can choose any company and buy its policy. As long as the details are filled correctly and honestly, you will get your money.

Is there still a problem?

While section 45 of Insurance Regulator Act 2015 did help in laying rules about all insurance companies approving the term insurance claims older than 3 years, it did not mention anything about the timeline within which companies have to settle the claims.

And this brings me to the third problem with CSR or the IRDA rule. It does not give insights into the delays in clearing the claims. There is no information on whether the claim is settled in 1 week, 1 month or 1 year. Since CSR reports are published by IRDA on annual basis, even if a company takes 11 months to clear the claim, it will still have high CSR. But this delay will result in a lot of hardship for the nominee who needs the money urgently as the breadwinner is no more and there are dependents to feed.

What can be done about it

Honestly speaking, IRDA cannot set a rule for it. Because there can be genuine reasons for the delays in settling the claims. Incomplete or wrong documentation, delays in responses from hospitals/nominees to the queries raised by insurance companies, not having nominee details updated in the policy, mismatch in bank records (name or account number mentioned in policy not matching the one provided by nominee) etc are few of such delays which are not in the hand of insurance companies as delay is happening from nominee side.

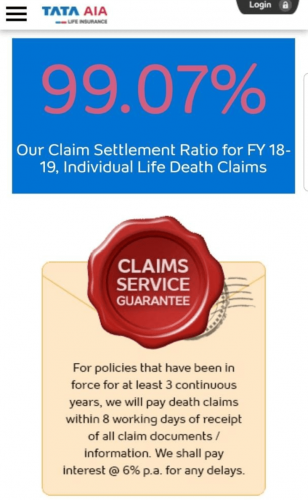

However, still there are few companies who are trying to fix this issue. For example, Tata AIA and Bharti AXA have started mentioning time period within which they will decide on the claim. As shown in screenshot below, Tata AIA says that they will settle the claim within 8 working days of receiving all documents. For any delays beyond this, they will pay interest to you. These are good intentions from the company to help people in need get their money soon and should be appreciated.

Conclusion

One thing we can conclude is to not rely on Claim Settlement Ratio while buying term insurance. Instead, look at other factors like Amount Settlement Ratio, Claim Rejection Ratio, Solvency Ratio, Brand Value of the company, how long has it been in market, is it a local company or national company or multi-national company, financial strength of the company to pay the claims etc while selecting the right Term Insurance policy.

Hope you have liked this article. If you want me to write next article detailing how to buy the right term insurance policy using above factors, then please mention the same in comments section below.