It is often said that we should not keep all our eggs in one basket. This is specially true in money matters as diversifying your investments will help reduce the risk of losses. In this article, I will explain you the different class of asset in which you can diversify your portfolio in India. Find out the asset class related to popular investment options like PPF, Mutual Fund, FD etc as well as understand the advantages, disadvantages and risks of each asset class.

What is an Asset Class

There are multiple options available today to invest your money. Each of them will have some characteristic. For convenience, these multiple options are grouped into asset classes basis these characteristics and similarities. So an Asset Class is basically market investment options grouped on some criteria (usually risks, returns, liquidity etc) and similar in fundamental ways.

Types of Asset Classes in India

Broadly speaking, all the investment options available in India can be classified into 7 Asset Types:

- Equities

- Fixed Income

- Debts

- Commodities

- Cash

- Real Estate

- Alternative Instruments

Let us understand each of these in detail

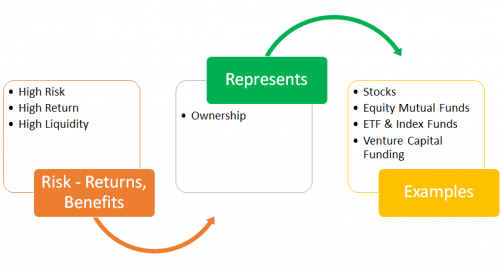

Equities

In simple terms, if you invest in equities, you are paying money to companies to become shareholders. So all your investments under Stocks and Mutual Funds fall under Equity Asset Class. The more shares you own, the higher ownership you will have on that company. And if you are owner, you will have to bear all the profits and losses the company makes. That is why equities are considered to be volatile class with possibility of high risks – high returns – high losses.

That being said, if you invest in right company, you will be able to reduce the risks and increase chances of profits.

Hence, equities are the most popular investment asset class in India. You should have atleast 25% of your portfolio invested in equities to beat inflation and help your money grow.

Fixed Income

Fixed Income Asset Class is based on promises. You promise to invest money for certain duration and at the end, you will be given your money back along with pre-decided interest rate.

Naturally these are safe and least risky because you are guaranteed to get your money and interest. Only disadvantage among these is the lock-in period. Your money will be stuck and you will not be able to withdraw until tenure ends. If you try to do pre-mature withdrawal, you might have to pay penalty.

So all your guaranteed return instruments like PPF, Sukanya Samriddhi, Fixed Deposits, Bonds, Post Office Schemes etc are part of Fixed Income.

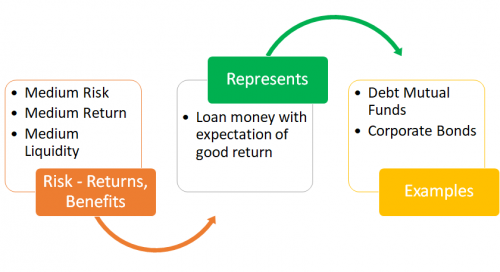

Debts

While Equity asset class gives you ownership, Debt asset class allows you to loan money to companies with an expectation of good return.

Note that in debt asset class, you are fundamentally loaning your money to private companies, state governments or central government. These company are free to use the money as they want on anything ranging from business expansion in new market, clearing debts, increasing capacity, acquiring or buying out competition, introducing new product line etc. Depending on the time you invest money, they will use the money and in return, give you a promise of decent returns at the time of exit.

Now, most of the times, these ventures will be successful and hence you will get good returns. However, there may be scenarios where the plans go wrong and company is unable to meet its obligations causing a risk of loosing money. Hence Debt returns are usually higher than the fixed deposit returns.

Cash

Cash and its equivalent is one of the most loved asset class globally. That is because you do not have to do anything here. Just let you money rest in your wallet, home or bank account.

So all your hard cash, foreign currency, money in locker and saving accounts, physical and online wallet etc are forms of cash.

Advantages are that it is universally accepted and you can use it as you want and when you want. There is no lock-in period on it.

Disadvantages are mostly related to it being stuck without any appreciation or growth in money. The saving account interest rates are mostly below inflation rate and hence even money lying idle there will keep reducing in purchase power.

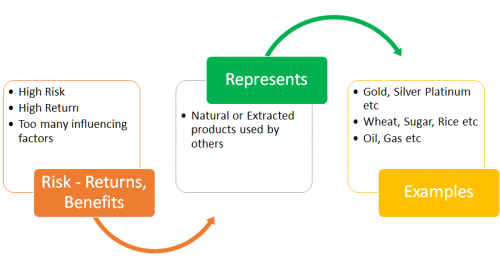

Commodities

Commodities are basically natural or extracted products which are used either directly or as material in other places. As an asset class, it offers you choices like metals (gold, silver, platnium , copper etc), energy products (crude oil, natural gas etc) and agriculture products (wheat, sugar, rice etc).

Problem with commodities as an investment asset type is that it is impacted by too many external conditions thereby making it very risky. You cannot guarantee what the oil price will be after 1 week or whether there will be good production of wheat this year or not. It is all speculation and basis that, risks are involved.

Real Estate

Real Estate is another most loved investment asset class for us Indians. We can invest in residential property, commercial property (office space, shops etc) or in land itself. Infact, now you can also invest in Real Estate via REITS.

Disadvantage is that selling of real estate is time consuming and you may not get the right price/buyer.

Alternative Investments

These are basically new investment ideas like art and wine collection, crypto currencies, NFTs, automobile collection etc.

While these can offer you good returns, concern here is that you can loose entire value if things go wrong. So if your art gets damaged or stolen, wine collection breaks, crypto currency becomes junk etc, you wont get any money back.

Hope above article will help you identify the right asset classes you want to diversify your portfolio into.