Corona Virus fear has crashed the stock market big time and created money-making opportunities. In this blog, I will mention how to benefit from falling markets and make money to buy Macbook at the cost of Windows laptop. Note that while the current market fall may be due to Corona Virus, the content of blog will remain same during any other future market fall as well.

SALE / DISCOUNT / OFF

As soon as people see these word, they go crazy. Be it the Republic day, Independence day, Big billion day, Diwali sale, Haloween sale, Black Friday sale etc, we are super excited. We eagerly wait for such sale and use the opportunity to buy stuff worth thousands of rupees.

However, when it comes to stock markets, for some unknown reason, exact opposite happens. People lose sanity and stop buying whenever there is any sale (ie crash) in the stock market.

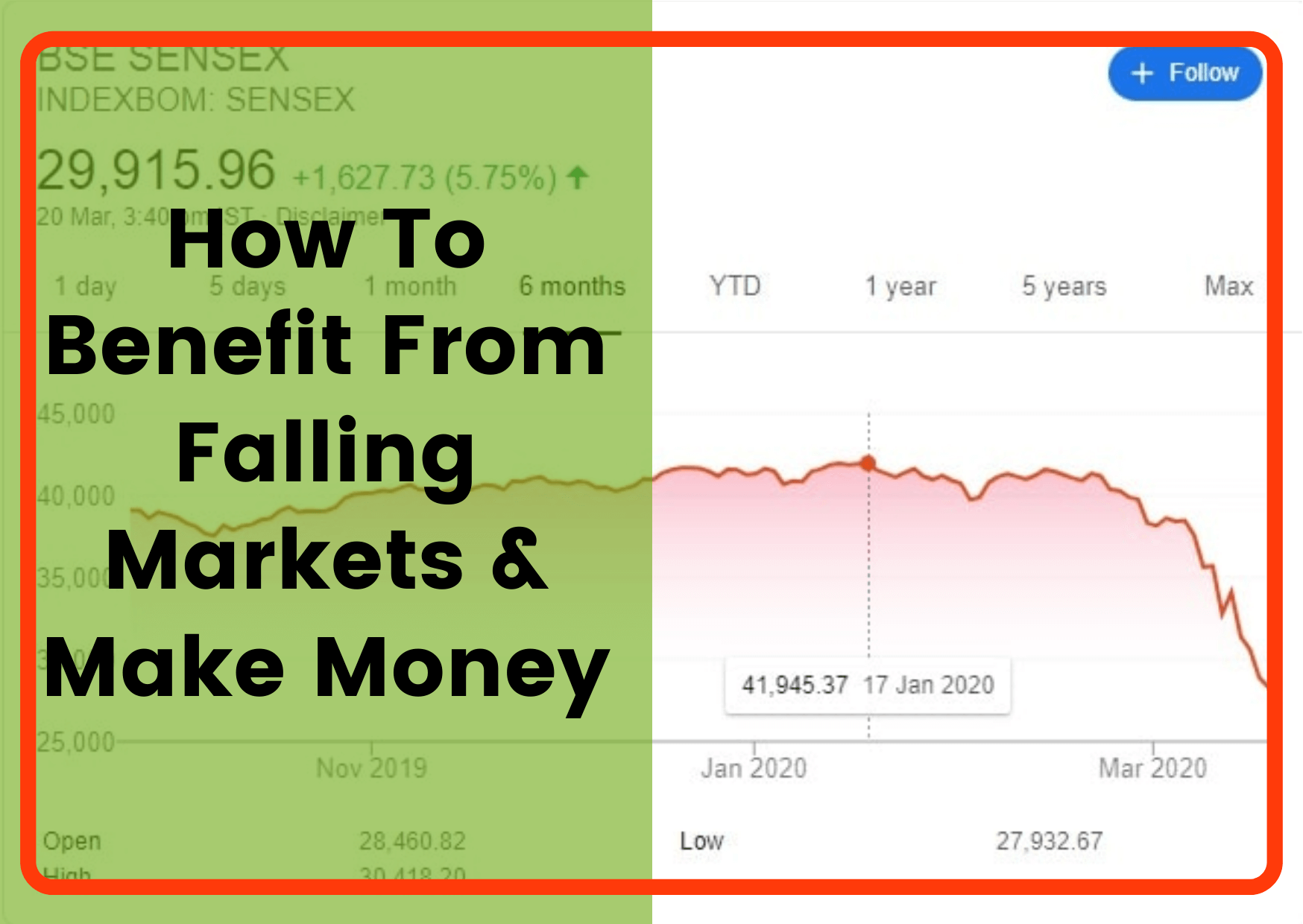

Just look at the current scenario. Indian stock market has crashed from around 42,000 in Jan 2020 to 28,000 in Mar 2020. It has lost over 10,000 points in the last 2 weeks itself causing everyone to panic. People are having jitters by the free fall in the market and are hesitant to invest money.

This is like knowing that there is a heavy sale going on things you want but you are not buying it. Instead of seeing this as a SALE (opportunity) and buying more, people are talking about losing money, stopping SIPs and staying away from stocks in the future.

Just see the conversation which happened with my colleagues last week

Parikshit – Yaar. This stock market is giving me panic. It has fallen so much in just a few days. And today (Friday 13 Mar 2020), it hit the circuit also.

Tushar – Haan yaar. I was checking my portfolio and see everything in red. Even in mutual funds, my gains have been wiped out. Better would have been to invest in FDs

Nishant – why are you taking tension. It is just a temporary phase that will pass. In fact, it is a good opportunity to make money.

Parikshit – Nopes. Not sure how much more it will fall. I am not investing even one rupee until I see market conditions improving

Nishant – But you will get everything at cheap price. Buying now will help you lower the average cost price and later earn high profit

Parikshit – What if it falls further? Mera to aur loss ho jaega na if I buy now

Nishant – Yes. You don’t know if market will go up or down. So it is better to invest now. If it falls further, it is good for you. Buy more and reduce your average purchase price. This will allow you higher profits when market goes up. So just follow the SIP strategy. Buy little amounts on daily, weekly or monthly basis and you should be good.

Tushar – But no one is sure about how long this may last. Corona virus is causing markets to fall and impacting economy. Many industries in Travel, airlines, tourism, media, entertainment, F&B, Retail, Auto etc will be impacted. A better idea is to save the money in FD/Cash and wait for things to improve

Nishant – With multiple countries and agencies trying hard globally, I am sure we will get some cure for the virus in the next few months. Once the cure is obtained and threat subsidized, government will have to start reviving the economy and we will enter bull run.

I do not understand why people fear when they know that market will bounce back. Everyone knows that crash cannot go on forever and eventually in few months or years, markets will go back to scaling new highs.

Historically, every bear run is followed by a bull run. And while no one can predict how long (or till when) the market will fall, we can assume that markets will start rising once the factors causing fears in the current market are resolved.

As shown in the below charts, historical returns after global diseases have been well over 25% in short term and 40% in long run. And even Sensex will surely go back to 42K level sooner or later.

Basis this, and assuming a figure of 50% returns on my investments, following are my plans to use the market crash to tick one item off my TO BUY list – a MacBook.

How I plan to buy Macbook at the cost of a Windows laptop:

Cost of Macbook = INR 1 Lakh. The amount I will invest = 67K (equivalent to the cost of a windows laptop)

Assumption = I will earn about 50% profits from current situation in stock market by following below steps. This will turn my 67K into 1 Lakh.

Step 1 – Start investing

March is the month of bonuses (and salary hikes from April in most organizations). My plan is to use my bonus and salary hike to invest for my goals. So, I will invest 67K in the market. I will do these over next 2 months by buying good quality shares and MFs.

Note => Notice that I have not dipped into my existing savings or stopped my existing SIPs for this. I do not want nor recommend anyone to use their emergency/retirement money for such gains.

You might say that it is easy for Nishant to plan this as he will have knowledge to find good shares/MFs which we don’t have. But don’t worry my friend. There are opportunities for everyone to benefit from the recent stock market crashes. I have listed the scenarios based on the type of investor:

- Having good knowledge of markets => Buy stocks with good technicals which are available at cheap price. There are many stocks in market which are trading at or near their 52 weeks low

- Having little knowledge of markets => If you do not know how to pick good stocks based on technicals, then a better option is to buy mutual funds. Invest in large-cap MF and you should have good returns when market goes up.

- Having No knowledge of markets => You may use a simple strategy to do this. Just pick Wealth magazine which is published every Monday with Times of India / Economic times newspaper. It gives list of best stocks and MFs every week. Pick any stock/fund with 5-star rating and invest in it via SIP. That is it 😉 And to be safe, stick to those among NIFTY 50 and large-cap funds. Do not buy penny stocks or small-cap MFs if you want to reduce risk.

Step 2 – Buy more when market falls further

In step 1, I mentioned that I will invest 67K in next 2 months. This will be done gradually instead of one-time activity. Every week, I will buy some stocks/MFs following the SIP funda => If the market is falling, I will try buying more and if market is rising, I will try buying less. But will buy whatever the situation until my 67K is invested within a maximum of 2 months.

How will this help => Buying more in a falling market will reduce my average purchase price allowing higher profits when I sell

What if you don’t have this much money to invest => this should not be an excuse. MFs investment can be done with even 500 rupees. So based on how much you can invest, either start SIP or keep purchasing for next few weeks.

Step 3 – Be patient and keep track of your portfolio

Now that you have invested the money, be patient. Do not panic or be reluctant to sell stock/MF if it is not doing well. Just keep a track of how your portfolio is doing and how close are you to your goal.

Step 4 – Start withdrawing when you are about to reach your goal

As you near your goal, plan to sell stocks/redeeming MFs to get the money in your account. Remember not to wait until 100% goal is reached for selling your investments. As soon as you hit 35-40% returns, start transferring 75-85% of the money to safer liquid/debt funds. If market continues to be good, you will soon achieve 100% of your goal. But if markets turn bad, you will not lose much.

In my case,when my investment of 67K gives 40% returns to reach 93.8K, I will withdraw 85% of the amount (79.7K) and transfer it to a liquid/debt fund via STP. Remaining will continue to be in the original stock/MF until my overall goal is achieved

Step 5 – Do not get greedy

Once your goal is achieved, ensure that you withdraw the amount. Do not get greedy in hope of higher profits and continue holding as market can crash anytime.

Step 6 – If market falls when you are near to redemption

Just go back to step 3 if your goal is not achieved.

Note – I do not have any particular time horizon for buying MacBook. As my goal is not time bound, I will not be impacted if step 6 happens However, I am hopeful that market will bounce back soon and I will be able to achieve my goal in next 2-3 years. I will keep updating this post to let you know on my progress.

So if your goals are not time-bound, please try this approach and let me know if you succeed 🙂

Next Article => Read part 2 of this blog => How I benefitted from growing markets and made money

Liked this article? Join my Whatsapp group to be part of our community!

Other articles worth reading:

Like saving money? Make sure you read my comprehensive article on Simple ways to save over 1 Lakh rupees per annum

Understand whether you should opt for new IT tax slab for FY20-21 or not

Must read article on How to buy the right Term Insurance

Read my detailed article on all the Must-Have credit cards if you love to Travel

Hi

I live in Nagaland. I am studying in University doing masters.

Very nice blog. Helped me plan a bit.

Hello

Very informative article. Every challenge is an opportunity. Well written sir.

Regards

Pranam

1) Graphs, Stats, examples to create a sceario

2) Day to day life conversations to make it intresting.

3) Detaild strategy for investing.

4) Mackbook— A attached dream to encompass all. 🙂

5) Simple approach and without heavy Jargons.

Well done. Kudos Nishant Sir.

This is must read for all beiginer who want to enter market now.

Very nice blog written in very simple language and easy to understand.

Nice work to help community

The post was really helpful and would also help many others who are in fearful situation right now.

Thanks.

Awesome blog Jiju 😊