NPS – National Pension Scheme – is the tool which guarantees you pension every month on retirement. The amount of pension depends on the percentage of NPS corpus you convert into Annuity. In this article, I will explain you what Annuities are, advantages of Annuity, types of Annuity, returns expected from Annuity, how to select the right Annuity and NPS Pension Calculator you can use for finding the pension amount.

What Is Annuity In NPS

Annuity is nothing but a contract between you and life insurance company. It says that you will pay a one-time lumpsum money to life insurance company and in return, they will pay you fixed amount every month/quarter/half-year/annum for a specific duration/event.

In NPS, when you turn 60, you have to convert minimum 40% of your corpus into Annuity. And this has to be done by buying Annuity plan from one of the 13 life insurance companies approved by NPS.

Following are the NPS Annuity Providers you can choose from:

- HDFC

- ICICI

- LIC

- SBI

- Star Union Dai-Chi

- India First

- Max

- Canara HSBC OBC

- Bajaj Allianz

- Tata AIA

- Edelweiss Tokyo

- PNB

- Kotak

Why should you buy Annuity Plan

Apart from that fact that NPS mandates buying an Annuity Plan with minimum 40% of your retirement corpus, another good reason is that Annuity will give you fixed payout every month. You will know at the time of purchase what pension you can receive monthly and this will not change during the policy period. Hence, you can have peace of mind knowing that a fixed % of money will come to you regularly every month.

Types of Annuities Offered Under NPS

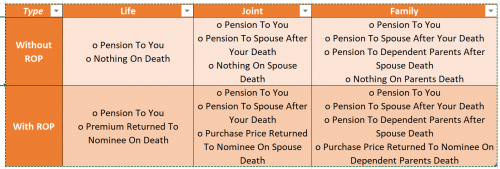

Broadly speaking, there are 4 types of annuities for you to choose from:

- Life Annuity – You will be paid fixed amount until you die. Once you die, payment stops

- Joint Life Annuity – Same as #1. But once you die, your spouse will be paid the money. Once he/she is no more, payment stops.

- Life Annuity with Return of Purchase Price (ROP) – You will be paid fixed amount until you die. On your death, the purchase price amount will be returned back to your nominee.

- Joint Life Annuity with ROP – Same as #3. Once the spouse also dies, purchase amount will be returned back to nominee.

- Family Income Plan (with or without ROP) – This ensure regular income to your family – first you will get, then your spouse will get and then your dependent parents will get the pension until their lifetime.

In addition, there are new options introduced regularly by Life Insurance Companies which can be checked on the insurance provider websites.

Expected Returns From Annuities

The Expected Returns from NPS Annuities depends on your requirements and the amount you need in pension. Below image gives you an insight into the returns you can expect based on different Annuity Types.

How Much Pension Can You Expect

Simple logic explains that if you want your corpus to last longer, you will have to spend less. That means, if you want Joint life Annuity or Annuity with ROP, your monthly pay-out will be less as compared to single Life Annuity Plan.

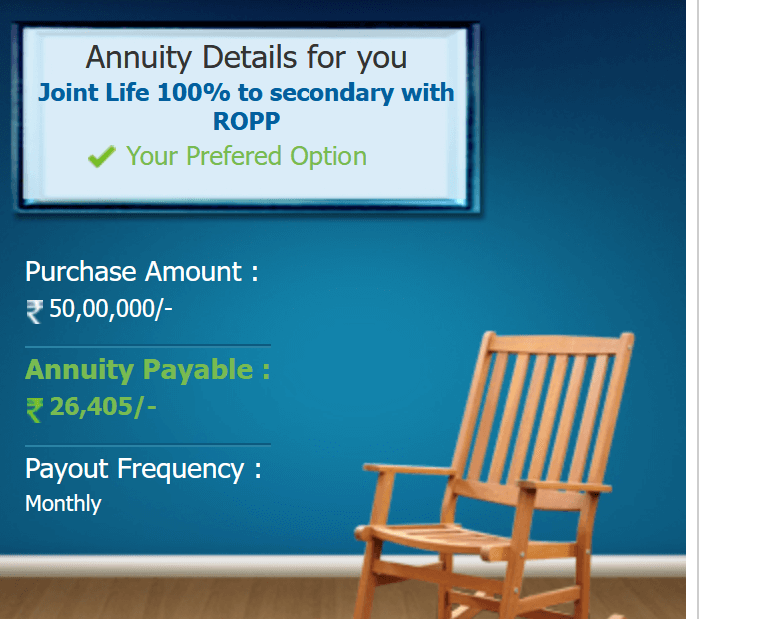

Below image shows you the approximate pension you will receive by buying Immediate Monthly Payout Annuity Plan worth 50L.

Note that the pension amount differs based on the annuity type chosen. You will get maximum pension in Life Annuity Without ROP.

Which Annuity To Purchase

Type of Annuity to be purchased should depend on your family needs. If there are no dependents, go for Life Annuity without ROP. But if you have dependents, prefer Joint/Family without ROP. Use ROP only in case you see very small difference in pension amount with/without ROP.

Among Annuity Providers, since all the life insurance companies are well regulated, you can buy Annuity from anyone you like. Apart from pension amount you will receive, also look at factors such as customer service of the insurance company, whether all transactions can be done online instead of visiting their office regularly, how near/far is their main office from your house if you have to visit and are they making entire process easy or cumbersome for end users.

How To Calculate Monthly Payout from NPS Pension Calculator

Your monthly payout will depend on the corpus and the type of annuity plan you choose.

Starting step can be to go to NPS website and check the consolidated list of returns / pension amount given by each of the authorized NPS Annuity Providers for different type of annuity. (as shown in Image 3 above).

Alternatively, you can also check the several online NPS Pension calculators available informing you about the pension you will receive every month.

Or you can visit the website of annuity providers and get premium amount from there.

I am sharing link of few for your benefit below:

In HDFC, for same criteria (50L, self age 60 yrs, spouse age 58 yrs), look at the different pension amounts – 34K vs 26K. Also note that there is only 100 rupees difference between Life Annuity with ROP (26,523/-) and Joint Life with ROP (26,405/-). In such case, you can think of taking the joint policy.

Here are links to NPS Returns Calculator for few other Annuity Provider

Max Life Annuity Pension Calculator

SBI Annuity Pension Calculator

ICICI Annuity Pension Calculator

Hope you liked this article. Please share your comments and feedback.