Another year has begun and most of us would have made resolutions for the year. But one resolution we all should make is to learn how to make our financial life happier. And this can easily be achieved if we streamline the way we handle our money matters. In this article, I have published a Personal Finance Calendar to help manage important aspects of finances month-wise. This way, you will never ever loose sight and have money moves to improve your personal finance.

So let us see what we all should do every month to help manage personal finance more effectively.

January

January is the time of year when everyone returns to work from winter vacations. People make goals and resolutions for the year. And hence, it is the best time to do following things:

Set Goals

List down all the goals and then rank them priority-wise. High priority should be given to those which you have to accomplish at all cost within certain time period – eg – retirement, child education, buying insurance, building emergency corpus, closing loans etc. Low priority can be given to goals which can be pushed or do not have fixed time frame – eg – buying car, foreign vacation etc.

Also identify goals you want to achieve this year and in next 3 years. For goals within 1 year, prioritize those in order of importance. So for example, my 2022 goals in order of importance can be to learn new skills, visit Ladakh and save for new mobile.

Create Annual budget

Once the goals have been ranked, set aside budget for the critical ones first. These are your non-negotiable goals for which you have to save money. From the money left, estimate how much you will need for monthly expenses, remaining goals and how much can be saved.

For goals scheduled for this year, see if you have budget to achieve all of them. If not, can the least important goal be pushed to next year?

For goals within 3 years, start reducing your equity exposure by moving funds to balanced hybrid or debt funds.

Basis the goal set, create/modify your portfolio and decide how much percentage you want to keep in each of the asset classes- equities, debts, gold, real estate and others.

Reduce Taxes on Capital Gains

The profits you make by selling your Mutual Funds and Shares is known as Capital Gains and are taxable. One good way to reduce taxation is by doing Tax Harvesting. It is a simple process where you sell and immediately buy the share/mutual fund while ensuring that your profits offset the losses. If you want to understand the Tax Harvesting process in detail, watch the two Youtube videos I had created on this topic:

Related video => What is Tax Harvesting (Part 1)

Related video => How to do Tax Harvesting (Part 2)

I will recommend that you start tax harvesting from January itself and continue it in February and March. This way, even if there is market crash, you will have time to harvest and benefit when markets rise.

February

Understand Union Budget

Union budget is presented by Finance Minister on 1st Feb every year. This budget gives overall idea of how you will be impacted as a customer – things getting costly/cheaper, new avenues for tax savings, which sectors will government focus on improving and so on. Everything announced in the budget will impact stock markets, country’s growth and you.

Bookmark this date, understand how the budget will impact you and accordingly plan for the year. For example, if tax rates are increased, you may want to plan investing more in tax saving instruments. Similarly if price of electronic items and cars are expected to reduce basis budget, it is better to postpone purchasing new TV/mobile or car by few months.

Tax Harvesting

As explained earlier, keep a lookout on market conditions and ensure Tax Harvesting is done in right way to reduce your total taxes.

Plan for Vacations

With approaching summer holidays, February is the time when people start planning their summer vacations. Keep a lookout on flight offers which airlines launch or any discount schemes launched by credit card companies / hotel chains. With trains also resorting to Dynamic Fares, it is better to book train tickets in advance at low costs rather than wait for last minute. Similarly if you plan to book homestays or villas via Airbnb/Saffronstays/Vistarooms etc, book in advance as soon as your plan is finalized and dates are locked.

One precaution which you should take especially during the Covid situation is cancellation policy. It is sometimes better to wait till last minute, look at situation and then book at higher rates than booking early and loosing entire money just because there is no cancellation policy.

March

Tax Harvesting

With March being the last month in Financial Year, ensure that Tax Harvesting is completed to maximize tax savings.

Check Insurance Cover

We all know the importance of insurance. And of course we all buy it. However, what we do not realize is how soon our insurance cover reduces due to increasing inflation and upgraded lifestyle. So the insurance policy purchased 5 years back thinking it is more than enough might not meet your needs today.

Even the other way is true – we keep getting insurance agents calls selling lucrative policies with immense benefits and we sometimes buy them without realizing whether we need that insurance. Or there are times when our dependent children start earning and are no longer needed to be covered under our insurance.

Hence, spend some time to check your insurance cover – are you under insured or over insured. If under insured, start researching on how much more insurance you need and which policy is right for you. If you are over-insured, identify the policy which should be discontinued.

Fund for PPF/SSY

March is the time when you should arrange for funding for Public Provident Fund and Sukanya Samriddhi Yojna. So aim to start a 1 year SIP mutual fund / fixed deposit somewhere around third week of March so that every year, it matures and you can have the funds in your account by end of March. As soon as April starts, you invest the entire eligible amount into PPF/SSY before 5th April to earn maximum interest

Related watch => How to increase your interest earning on PPF/SSY

Pay Advance Tax

If you are eligible to pay Advance tax, ensure that it is paid before end of every quarter. Hence I have marked this as a reminder date – to be completed before 31st March / 30th June / 30th Sep / 31st Dec.

April

Invest in PPF / SSY

As mentioned above, you should aim to invest the entire allowed amount in PPF and Sukanya Samriddhi Yojna before 5th April every year. This is because interest calculation for previous financial year is done basis the balance on 5th April. And since the money is compounding on PPF/SSY, it is beneficial for you to invest early.

Increase SIP

April is normally the month when most companies give annual bonus and salary increments to their employees. So, it is the right time to step up your investments to achieve your retirement goal (first preference) and other goals. And this is where the goal setting exercise we had done in January will help us. Use it to find out how much money is required when and accordingly invest the money in order or priority.

Increase Insurance Cover

Basis the Insurance check we had done in March, buy additional Insurance cover if required. If you are happy with your insurance provider, you can take a top-up on the sum assured instead of buying a new policy. But in case you are unhappy with existing insurance company, you can port your insurance policy to some other provider (either at same Sum Assured or Higher Sum assured).

Tip – While you might not need to buy additional cover every year, remember to do this activity atleast once every 3-4 years

Tip – In Insurance, premiums depend on the age of person. So remember to buy insurance before birthday. And if your birthday is before April, this activity should be done before the birthday.

Related watch => Things to remember while Porting Health Insurance policy

Related watch => How to Port health insurance policy

Increase Emergency Cover

With increase in age, salary and your lifestyle, you should also keep an eye on how the amount of emergency cover you require. High salary and experience can result in increased chances of job loss in case company/market is not performing well. At the same time, they will be a barrier in finding alternate job quickly. Similarly rising costs related to education of children, lifestyle and inflation will result in higher monthly expenses. Hence those above 40 should increase their emergency cover to 10-12 times monthly expenses.

May

Consolidate

After all the hard work you have done in April – increasing SIP, insurance cover, emergency cover – it is time to consolidate your finances. List down all your assets and liabilities at one place and hand it over to your spouse and family members. Remember that life is unpredictable and there is no use of all the wealth you leave for them if they don’t know about it. Hence, do not forget to share with your family and ensure they know what to do / how to use it.

Create/Update Will

Once your finances are consolidated, use that information to write a will. Will can and should be written by everyone. it is easy to write and all you need is just a pen and paper. Clearly explain how you want your assets to be distributed after your death so that there are no internal fights.

If your will is aleady created, review it once to make sure it is uptodate.

Related video => How to make a Will

Related video => How to write a Will

June

In June, focus on collecting Form 16, Form 26AS, Form AIS, Capital Gain Statements, Bank Interest statements and other tax related documents. Start analyzing them to understand where things stand from tax point of view.

Check Portfolio health

Use the portfolio created in January as part of goal setting / annual budget creation and check how it is performing. Have you adhered to your target asset allocations, are your MF returns matching or beating the market returns given by competitors and benchmark indices, are any MF not performing well, are your loan interest rates in line with market rates etc . This will give you an idea of your portfolio health and the steps you need to take to correct your portfolio health.

Pay advance tax

As mentioned earlier you have to pay advance tax every quarter and 31st June is the target for April-May-June quarter.

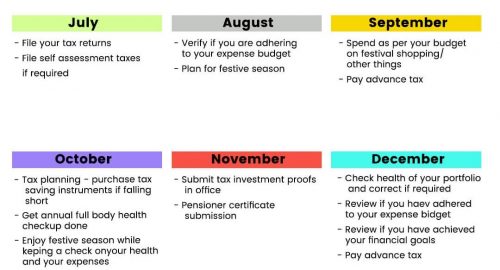

July

File Taxes

July is all about tax filing. So ensure that you file your IT Returns before 31st of July every year. Similarly also calculate your Advanced tax and Self Assessment taxes and pay them online.

August

Plan for Festival Season

Festival season in India starts from August/September and go on till December. So spend some time in August beginning to check if you are adhering to the Annual Expense Budget you had created in January.

Basis this exercise, you should plan for the upcoming festival season. If you are overspending, try to cut-down on the expenses during festive season. If you are underspending, you can either use saved money to fulfill one more wish of your family or you can save it for future goal.

September

Spend within your limit

It is very easy to get carried away seeing all the big discount sale happening everywhere. This is where people loose control of their expenses and buy things even if they cant afford it. Zero cost EMI and Buy Now Pay Later have forced people to make big ticket purchases without thinking twice.

Instead of joining the crowd and buying recklessly, be smart and buy only what you need and which is within your budget calculated in August. If you are a spendthrift and use a credit card, better idea will be to either use a debit card or reduce spend limit on your credit card.

Pay advance tax

As mentioned earlier you have to pay advance tax every quarter and 30th September is the target for July-August-September quarter.

October

Tax Investments

If you are still relying on old tax regime, start your tax planning. Purchase right tax saving instruments if you are falling short on 80C / 80D limit. Use tax exemptions in NPS, donations and other activities if you are interested. Look at your capital gains to identify the steps you can take to reduce taxes.

Also, start collecting the investment proofs so that you have them ready as and when your office requests you to submit them.

Health Check

The saying that Health is Wealth is so true in today’s lifestyle. We see people getting heart attacks or undergoing bypass surgery in their 30s, back and neck problems are very common for IT professionals, most people suffer from diabeties, cholestrol, BP, sugar and many other diseases. Hence, it is important to focus on your health. Get a full body health check-up done every year in October (preferably before festival season). This way, you will be able to enjoy the festivals and eat all the sweets and delicacies prepared while keeping an eye on your health and as per the recommendation from doctor.

November

Submit Proofs

November 30th is the deadline by when senior citizens have to submit life certificate for availing pension and other benefits.

Most office also start asking for investment proofs around November/December.

December

Time to review

Finally you have reached the year-end and it is time to relax and enjoy the holidays. However, before doing that, just spend some time to do the following:

- Review if you have adhered to your budget and expense goals for the year

- Review the health of your portfolio – see if your MF are giving you better returns than market or atleast matching them

- Review the goals you had planned for the year and identify how many have been achieved

Pay advance tax

As mentioned earlier you have to pay advance tax every quarter and 31st December is the target for October – November – December quarter.

All Year Work

Apart from monthly task, following are few things which should be done as and when they occur:

- Insurance Renewals

- Credit Card Renewals – If using a paid credit card, think if you really need that card. If not, cancel it.

Hope you will be able to use this Personal Finance calendar to manage finances better. Do share your views and feedback.