Rent v Buy a house is a dilemma we all have faced in our life. Conventional wisdom and the pride of owning a house push most of us into taking home loans. However, there are lots of other things we should consider while deciding on renting vs buying a house to get the real answer.

In this blog, we will consider both Financial and Non-Financial aspects before making rent vs buy decision.

I have also included a bonus buy vs rent calculator excel for you at the end of this article.

Financial Aspect of Rent vs Buy

Let us do some number crunching to see which among renting or buying is better financially

Buying a House

Analysis is done with following assumptions:

- Value of flat = 80 Lakhs, possession after 3 years (36 months), 20% down payment via self-contribution and 80% loan taken at 8.5% for 15 years with no prepayment

- Currently, staying in a rented apartment with a monthly rent of 20K with a 10% increase in rent every 11 months

- Have not factored costs related to rent agreement, registration, etc.

- The life of building is expected to be 30 years. After that, the house will either be sold or reconstructed

- There is 5% appreciation in property every year

- Property tax in 7K for first year and increases at 5% per year

- 5L is spent on interior decoration work after possession of flat

- 3L is spent on house maintenance (whitewash/repair etc) every 7 years

- The person buying the flat is in 30% tax slab and claims maximum possible tax rebate per year in interest component

Calculations for buying the house

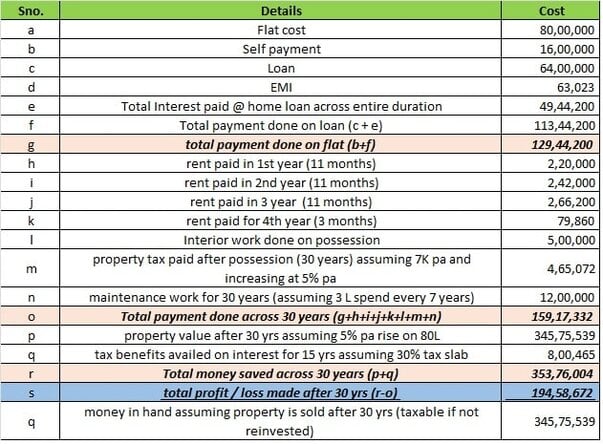

Let us look at the numbers when you buy the house:

Note – Since rent is increasing every 11 months and our flat possession is after 3 years (36 months), we had to calculate rent for 3 months of 4th year in row#k

From the above table, we see that after 30 years of owning the house, you make a profit of 1.9 Cr with the house still in your name. If you sell the house after 30 years, you will get about 3.4 Cr in hand. However, this is completely based on the assumption that you will be able to sell the flat after 30 years. If the building gets demolished for reconstruction, then you will not have any money and will have to invest from your own pocket for reconstruction.

Also Read – How to make a Will for free in India

Staying on Rent

Following are the assumptions:

- Down-payment amount of home loan (20% of property value) is invested for 30 years with 12% pa return

- Until the time annual rent paid is lower than annual EMI paid (if house loan was taken), we invest the saving to get 12% pa return for the number of years left. For example, we invest for 30 years in year 1, 29 years in year 2, 28 years in year 3 and so on.

- Since rent is increasing every 11 months, we have considered year as that of 11 months and adjusted 360 months (of normal 30 years) to 32 years and 8 months of 11 year calendar. All calculations have been done accordingly

Calculations for renting the house

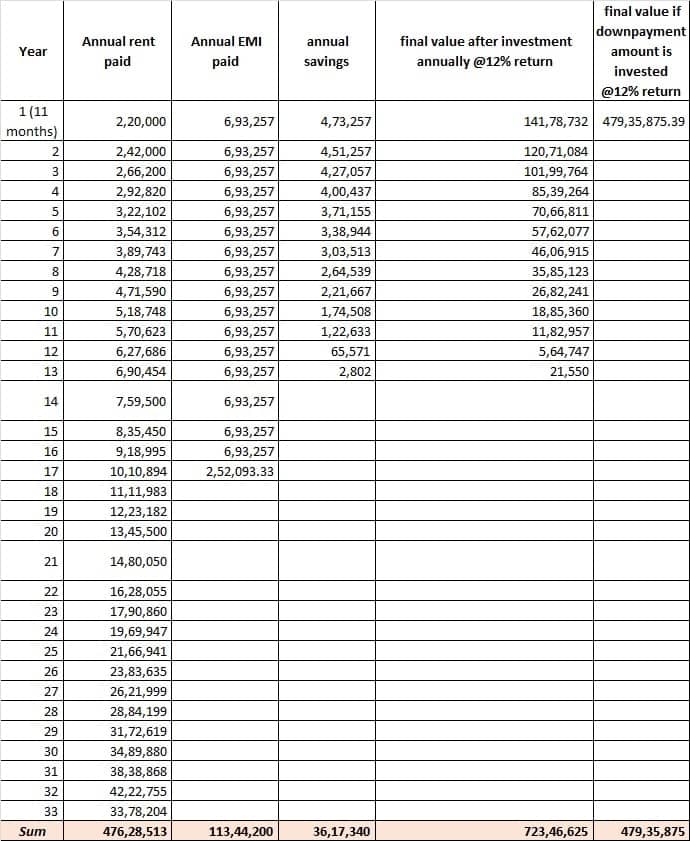

Now let us look at the calculations if you rent a house.

Notice that until year 13 of the above table, your annual rent is lower than annual EMI. However, 14th year onwards, annual rent is higher than EMI. At this point, your annual savings will stop.

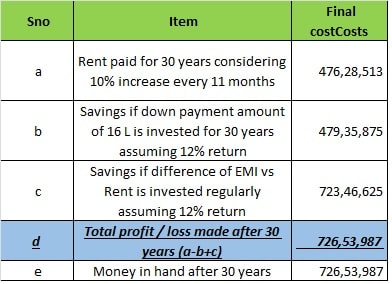

From above calculations, following is what we get if we stay on rent for 30 years

Basis above table, it is very clear that it is better to rent the house. You will not only have more money in hand after 30 years (7.2 Cr as compared to 3.4 Cr from own house), but also save the tension associated with paying EMIs across 15 years.

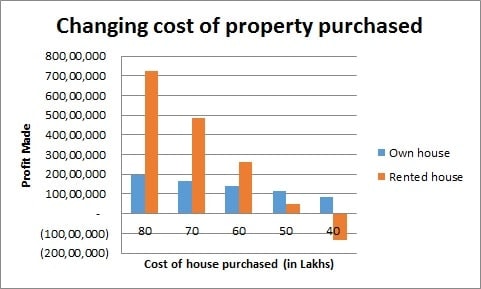

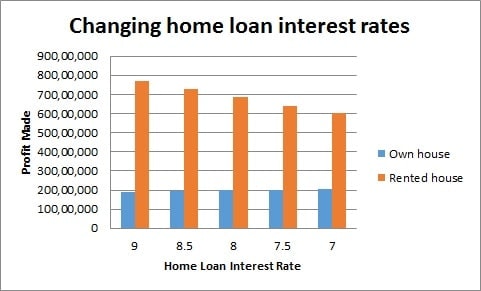

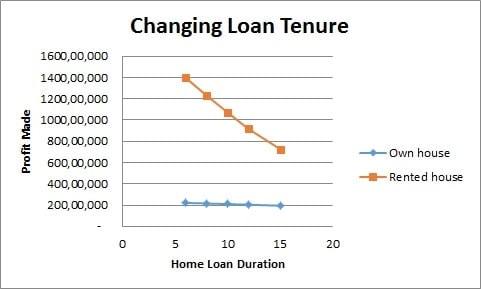

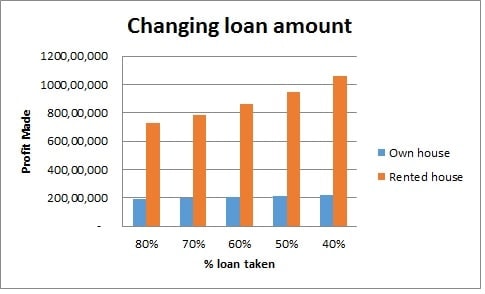

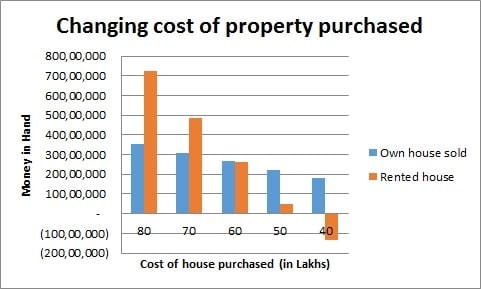

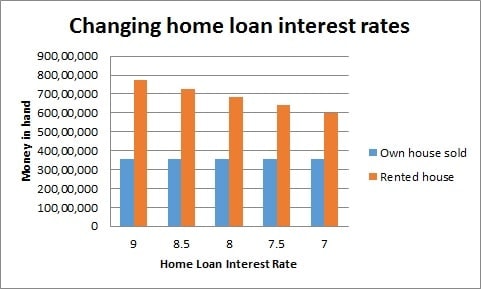

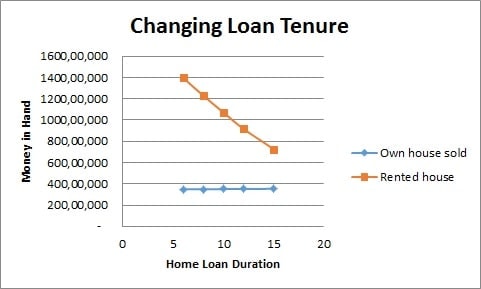

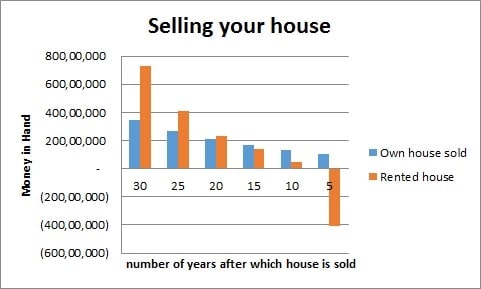

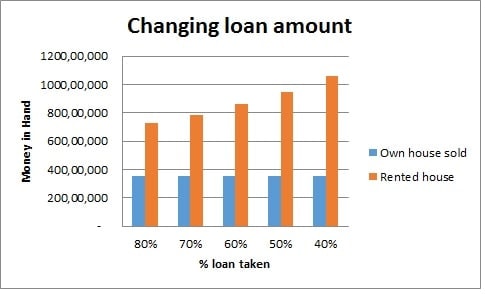

Now, let us see what happens if various parameters are changed.

Impact of changing various parameters on Profits and Money in Hand

Observe that when calculated from profit perspective, owning a house is better only in following scenarios:

- You purchase a very low cost property (<=50 Lakh in our example)

- You sell your house very early (<=5 years in our example)

In all other scenario, renting a house is better.

Similar results are observed for Money in Hand (from sale of property vs investments from rent) calculations as shown below

For money in hand parameter, owning a house is better only in following scenarios:

- You purchase a very low-cost property (<=60 Lakh in our example)

- You sell your house very early (<=15 years in our example)

From financial aspect, all the above scenarios can be summarized in below points:

- Always try buying low-cost property (preferably in an upcoming area which can give higher appreciation)

- It is always better to rent if you have taken a huge loan and holding the house for a long duration.

- The amount of home loan taken does not matter. If you take less loan, it means higher self-payment. Same money will give you greater returns via investment. So renting a house is always the best option in such cases

Non-Financial Aspects of Rent vs Buy

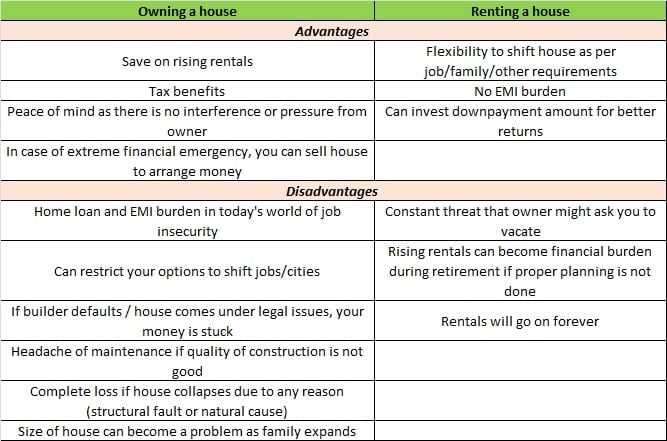

Another thing we should focus on is the non-financial aspect while making this decision. Below table shows the pros and cons of each case.

While making a decision, you need to know your long term plans. For people who frequently change jobs/cities, it is emotionally difficult to rent out your own house and stay elsewhere at rent.

Similarly, there are many examples where builders have defaulted and the project has been stalled due to some reason. Those who buy during the pre-launch or early stage of construction face another problem. No matter how reputed or financially strong the builder is, you never know when things may change. A classic example of this was observed during demonetization and implementation of RERA which forced many builders to go bankrupt and stall projects. There are a number of housing societies under construction in NCR (and other cities) that are not completed and legal cases are being dragged on. This will cause a huge burden on you who will be paying both rents as well as EMI.

Instead of going through all these headaches, a wiser approach will be to buy a completed project where you can move-in immediately. While you might have to shell out a few more lakh rupees, you will save on rentals and get the house immediately. You can also look into buying the house you currently stay on rent. This is a good idea because you know the problems, quality of construction and are already comfortable in it.

One must also remember the future needs while deciding the size of house. Questions like number of kids you plan to raise, whether your parents will be living with you, whether there are frequent guests who come to stay with you should impact the size of the house to be taken.

Conclusion

Moving into one’s own house is a dream come true for everyone. However, this dream comes at a great cost. You should look at various factors (both financial and non-financial) while deciding whether to buy a house or stay on rent. If your financial savings via rent are higher than via owning, then it is always better to rent a house. However, if your financial savings via owning is higher, it is mandatory to consider the non-financial aspects before making a decision.

Bonus

To help you decide easily, I am attaching Rent vs Buying a house template with this article.

Note – To keep things simple, for this template, I have assumed that rent will increase every 12 months instead of 11 months.

How to Use

- Fill data in cells highlighted in Yellow color

- See the results in cells highlighted in Green color

Updates – Basis inputs from one of our readers, I have added Decision Matrix 2 in the template. This is for those sincere customers who start investing the EMI amount after their home loan has finished. The amount is invested till the time property is sold.

Hope you find the template useful in making the decision.

I also offer a financial consulting and can help you achieve your financial goals with proper planning. You can schedule a free consultation call to discuss your concerns and we can take it from there.

Liked this article? Join my Whatsapp group to be part of our community!

Other articles worth reading:

Also read – Is 1 Crore Enough for Retirement?

Also read – 7 Must Have Insurance in 2021

Another interesting article – How PPF Interest is Calculated

If I increase the number of payments, ideally the EMI should go up & interest should reduce. However, the same is not happening. Also, you can include an option for step up EMI % wise, which could make the calculator more robust to accommodate more scenarios.

Very nice article. I agree with all points, except in case renting there is no hard & fast rule that it will increase every year at rate of 10 % .In Pune I observed every year my landlord increased rent by only rs 500 to 1000 when i was paying rent of 7000 for 1BHK. So this is also plus point for renting.

Hello Nishant,

Thank you for a very explicit & yet simplistic explanation & also for providing the easy to use template. It gave me so much clarity as I am currently going through the process of this decision making.

However, there are a couple of things that can be covered to make it even better I think:

1. Include a maintenance fee that is to be paid even for an owned house (apartment)

2. HRA benefit of paying rent

3. Tax benefit on home loan emi

4. Tax on capital gains or TDS by investing in other platforms (equity/MF/FD etc.)

5. PM Yojna which gives up to 2 lakh benefit for the first time buyers

Hi Jai.. Glad to help 🙂

Coming to your suggestions, point #1 (maintenance fee) and #3 (tax benefit) have already been considered in calculations – see row#m, n and q under image 1.

Your point #2 (hra benefit) and #5 (PM Yojna) – They should ideally be considered. But as we already see huge difference in rent vs buy calculations, I think these small benefits won’t impact final numbers much.

For point#4 (TDS on other platforms) – I feel this can be managed. Tax saving MF, harvesting, and other methods can take care of it

Hi Nishant,

I liked your approach to the general problem of the masses in present. However, in the section mentioning to take loan <@50% of the property,Instead of taking lower loan what about if we take 80% as loan and invest the in hand cash alongside?

Nishant, very good article..you really nailed it.

Can you please show calculation with 8% returns instead of 12% for the invested savings amount.

Hi Vinay,

Please use the attached template to put in your numbers and see the results 🙂

Nishant

This is really a very nice article on rent VS buying a house.

Your efforts and anylasis appreciated.

I really need something like this.

Thankful for excel attached to input my data to calculate for my own.

Thanks Vikas. Glad you liked it. Please share with others 🙂

What about the rental payment which continues beyond 17th year while the EMI stops? And the excess rental from 14th year? If that amount is also invested at 12% annual return by a home owner, I’m sure it can give a very handsome return to him or her.

Thanks for bringing this up Dheeraj. I have updated the template basis your points.

As per new calculations, property value below 90 Lakhs should be purchased. Else one should continue staying on rent.

Excellent and very realistic calculation , I think everyone should read before buying any property .

Thanks Manish 🙂

Hi, Good Anaysis,. Some comments though:

Assumption of 12% annual return on savings doesn’t hold true for 30 years.. Subjected to stock market risk.

Hoising loan interest rate is currently at lowest ever.. I think u have assumed at 9%

Hi Vicky,

Thanks for liking the article.

12% return on saving is just an assumption. Continued SIP during bad and good times may definitely give this much or higher returns in the long run.

Yes. Housing loan interest rate is low now. But if you see the graphs (Image 4 and 5), this will not matter in the decision as renting a property will always be beneficial no matter what the interest rate.