LIFE… such a beautiful and uncertain thing. We all know that life is unpredictable and one can die anytime. This is more true in Covid-19 world where anyone can get infected. Still, most of the households in India have one thing in common – the finances of family are known only to 1 -2 members of the family.

Take a small test. Ask your spouse AND parents to list down your financial details. Do they know which all bank accounts you have, what are your assets and liabilities, where all have you invested in, what all policies you hold and how much money they will receive on your death (and from where).

I am sure most of us will not know these details. Hence, it is important that we focus on ensuring that our finances are known and passed on to our family after our death (a concept known as Estate Planning).

Most of us believe that nomination and joint ownership is a way of estate planning. However, both these means are usually ineffective and legally disputable. It is important to know that nomination and joint ownership are both superseded by succession laws. Most family disputes have arisen owning to nomination / joint ownership being different individuals compared with legal heirs.

source => Business World

While I may cover Estate Planning in detail in a future blog, this article focuses on the first step of Estate Planning => knowing all your finances.

I am sharing the excel which I have been using to capture such information via a very simple template. I call this Financial Booklet. Using this financial booklet (or anything similar), you and your family members will always know your financial conditions in case you are not around.

This financial booklet will be your first step towards Financial Planning and Estate Planning.

Step 1 – Create/Update the financial booklet with all your financial details

- Download the financial booklet template from below link.

- List down all the information as requested in various worksheets for following:

- Bank accounts => including Salary, Saving, Current, PPF, Sukanya etc.

- Insurance policies => including Term, Life, Medical, Cancer, Disability, Accidental, Home, Motor etc.

- Assets & Investments => includes Stocks, MF, Property, Esops, PF & Gratuity, PPF/Sukanya/NSC/KVP/SCSS, Gold, ETFs, Infra, Bonds, FD/RD etc.

- Loans & Liabilities => Home/Vehicle/Educational/Personal/Other loans, other EMIs, credit cards, club memberships etc.

- List all loans & liabilities here. Note that all the credit cards, club memberships etc you hold should be listed here as they are liabilities. They may keep incurring annual charges and your family should know about it

- While this will be a time-consuming activity, ensure that you do it as thoroughly as possible. Remember that this is the most useful work you would have done for your family to survive in future

Note => It is important that you correctly identify Asset vs Liability. For simplicity, remember that anything which gives you money is Asset and anything which takes your money is Liability. For example, a house can be Liability if you are still paying home loan. But it can turn to an asset if there is no loan on it

Quick Tip => Use the consolidated email from different regulators to know what all you hold. Few such regulators are NSDL CAS (for MF/Stocks) and National Insurance Repository (for insurance policies). Register on their website if you are not receiving the mail. Also, ensure you add all missing policies to these regulators list for future benefits.

Step 2 – Update the wrong / missing information in corresponding account/policies

- Note down all the changes which have to be done in each of the policies. These can be address/phone number/mail id/adhaar/nominee update.

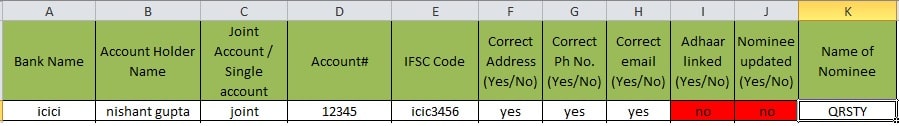

- For your convenience, the template automatically highlights these cells in a different color (as shown in the image)

- Reach out to respective customer care via phone/email and see if the details can be updated/corrected

- If they insist on visiting the branch or sending courier, get this done asap after lockdown ends

- Once rectification is done, update the booklet and save it.

Step 3 – Analyse portfolio and decide what you want to keep/close/remove

- Check if you want to close any of the bank accounts – Since all banks charge annual fees (for debit cards issued to non-salary accounts) and extra charges if minimum average balance is not met, it is important that you keep only those bank accounts which you need/use.

- Check policies that have expired/matured. Claim the benefits/amount if applicable for matured policies

- Analyze if you need (not want) to continue renewing any particular policy. I have stressed on need because many times you will have policies that you just keep continuing even if they are no longer useful. Few such examples are LIC policies, ULIPs, Term Insurance etc. If you feel that they are not giving enough benefits or if you find a better alternative in market, stop these policies.

With new tax regulations, you can now stop policies you had purchased last minute to save tax. Read my article on which tax regime is beneficial for you to get more details

- Check the Return on Investment column (column L) on Assets & Investments worksheet. Since average inflation over years has been around 6%, your investments must give more ROI. The template again highlights all investments with ROI less than 6%. Think whether you want to continue with such investments. Ideally if such trend continues for long period, you should move out of that investment.

Step 4 – Write a will

Don’t assume that will is only for rich or old. Will should be written by everyone as it will help your family get their dues easily without any legal hassles. Consider will as the topmost authority for everything. If a will is there, no one can unlawfully/wrongly capture your assets.

And it is very easy to write a will. If you think there will not be any fight in the family after your death, then simply write a will on plain paper (preferably handwritten), sign all pages yourself, get it signed by witnesses and notarize it (if you want). However, if you don’t want challenges on authenticity of the will, you can also get it registered. Apart from handwritten wills, you can also make Video will. You can also create online will easily via multiple websites available from google search

Read following links to know more on wills. :

Why and How to write your will => Click here (opens in new tab)

How to make will in India => Click here (opens in new tab)

Step 5 – Share

Now that your booklet is ready, make it password protected (File – Info – Permissions – Encrypt with Password) and share it with your family

Step 6 – Review this booklet regularly

Ensure that you check your sheet every 6 months (preferred) or once every year (mandatory). And share the revised sheet with Family.

Hope you find this blog and the template useful and take first step towards Financial Planning. Next step will be finding a good financial planner (either online or offline). If interested, drop me a note and I can recommend couple of good planners.

Sir look at your other blogs. The comments are being made by someone who is making fun about you. Look at the ”names” of the people in those comments. Most of the names are foul words in different languages . I am from tamil nadu so i understood some words.

Hi Vijay,

Thanks for pointing out. But I do not care or get affected by such people. I just pity such people who waste their time and efforts on such things which dont mean anything to me.