Ever since the finance minister announced new IT slabs for FY2020-21 and gave consumers the option of choosing among old vs new income tax slabs, everyone is trying hard to find out what is best for them.

This article is aimed at helping everyone to selecting the right option between old vs new income tax slabs in India.

What has changed?

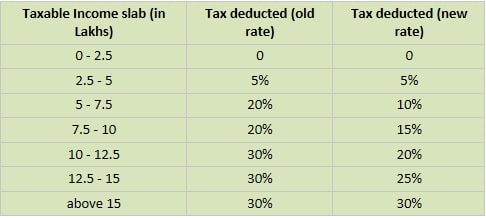

Let us first look at the old vs the new income tax slab rates.

In old tax rates, tax slab jumped from 5% directly to 20% causing lots of financial burden on the middle class in 5 – 10 Lakh taxable income range. The government has tried to address this concern. Now, there is a 5% tax increase on every 2.5 Lakh rupees.

However, in doing so, government has played smart and said that people can opt for new tax slabs only if they do not avail tax exemptions. If they want to avail tax exemptions, they can continue using old slabs.

What is removed from exemptions in new Tax structure?

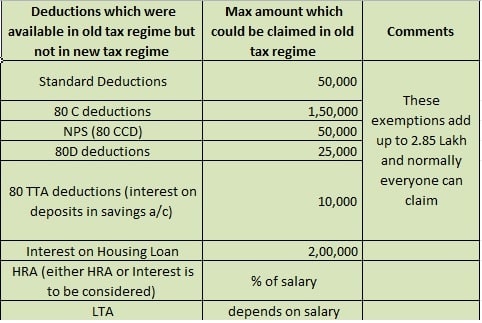

Following are few of the key deductions which are no longer part of IT exemptions in new tax rate:

However, following will still be exempted under the new regime:

- Employers contribution in PF up to 12% of Basic

- NPS Employer contribution up to 10% of Basic

Which tax rate to choose?

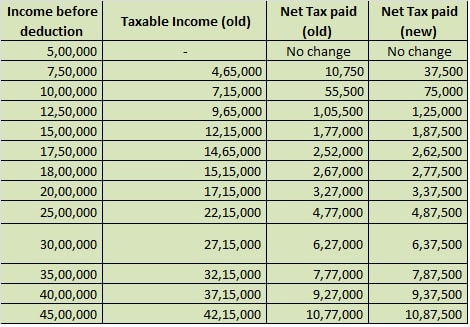

Based on the above information, let us now look at whether you should continue with old tax rates or move to new one.

For simplification, we have assumed that employees can take the maximum deduction (2.85 Lakh) in the old tax structure. We have not considered HRA/LTA/Housing Loan Interest

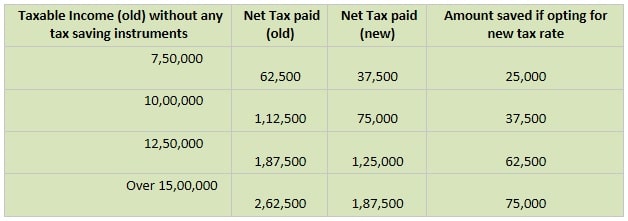

Notice that in all cases, tax paid on the old tax rate is less. However, this is assuming you take full deductions of 2.85 Lakhs and above.

What if my deductions are less?

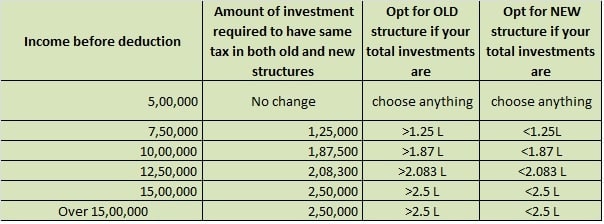

But what happens if your total deductions are less than 2.85 Lakhs? Don’t worry! Simply refer to below table to decide which tax rate to go with.

So who benefits from new tax rates?

People who cannot meet the breakeven points showed in the above table benefit the most. These can include youngsters who have just started working, people who do not have any tax saving schemes, people who want more money in hand, people who are about to reach retirement and don’t want to buy new tax-saving instruments etc.

One benefit of new tax rate is that customers will not be forced to buy tax saving schemes at the last hour without knowing the full benefits. They can get more money in hand which can be invested (hopefully instead of spending) to plan their future.

See the table below explaining this. If a person with 10 Lakh income does not do any tax saving, then the total tax he has to pay is 1.125 Lakh (via old tax rate) vs 0.75 Lakh (via new tax rate). By moving to the new tax rate, he can save 37.5K. This is in addition to the 2.85 Lakh he has saved by not being forced to buy tax-saving products mentioned in Image 2 above (like ELSS, ULIPS etc.)

Conclusion

Government has given you the liberty to choose and this will help everyone. Customers should understand not to mix investments with Tax savings. They should consciously make a decision whether to buy anything for tax saving or not.

I hope this article was able to clear the confusion and help you decide which tax rate to choose. Just remember to choose wisely 🙂

If you liked this article, then do read my article on How to buy the right Term Insurance

very useful

Thanks

Hi Nishant, what if someone moves to new slabs in FY20-21 and then decides to comeback to old slabs from FY21-22. Is it possible?

Hi Vikram,

There is no communication from government on this. So for now, you may assume that you can change it next year 🙂

Great article jiju 🙂

Great article jiju.. 🙂

Kya baat hai, paaji! 😊

Spot On..Nice explanation.

Thanks Amol

Very helpful..

Very informative!

A detailed and simplified analysis

Good article Nishant. 🙂

Very insightful article!! Gives lot of clarity and help you decide which way to go!!