1 Crore! That seems to be the magic figure for most people when doing retirement planning. They feel that if they achieve a retirement corpus of 1 Crore in India, they can retire comfortably.

In this blog, we will find out if 1 Crore retirement corpus is enough in India? If not, how much corpus should one have before even thinking of retirement? We will also give suggestions on the best options to invest this retirement corpus so that it lasts your lifetime.

We will use a case study to get the answers.

Case Study:

Ravi has just returned home after completing his MBA. His parents will turn 60 and retire in a month. They ask for his help in their retirement planning. They have a retirement corpus of 1Cr in saving account. They expect to live till the age of 90 yrs and have adequate health insurance. All they are looking for is monthly income of 40K and 1L every 2 years for vacations.

Assume average inflation of 7%.

Where should Ravi suggest his parents invest 1 Cr retirement corpus to meet the above goals for next 30 years?

Also Read: Rent vs Buy a house – Which is better?

Solution Analysis:

First let us look at what options Ravi has to invest corpus of 1 Crore. Since his parents are approaching 60, ideally Ravi should look to invest in safe avenues like pension schemes and government backed securities/bonds etc.

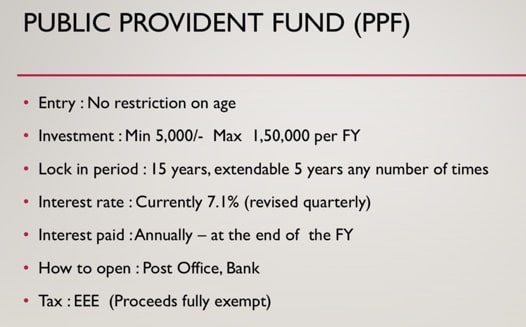

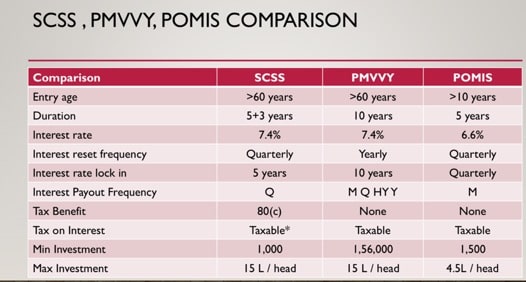

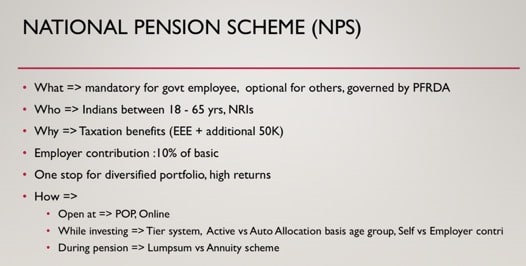

Few options he has are Public Provident Fund (PPF), Senior Citizen Saving Scheme (SCSS), Pradhan Mantri Vandan Vyay Yojna (PMVVY), Post Office Monthly Income Scheme (POMIS) and National Pension Scheme (NPS).

Salient features of these are listed below for convenience.

Basis above data, Ravi has options to invest in PPF / SCSS / PMVVY / POMIS / NPS. He rules out PPF due to 15 years lock-in and POMIS due to low interest rates.

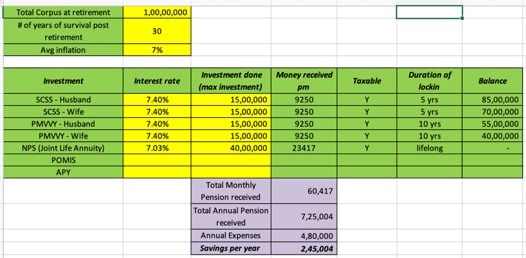

To get maximum benefit, Ravi invests in SCSS, PMVVY and NPS. For SCSS and PMVVY, since he is getting lock-in on interest rates for long years, he chooses to invest up to the maximum limit of 15 Lakhs in both his mother and father’s name.

Basis this, he distributes 1 Crore corpus in following manner:

- SCSS – 15 Lakhs each in mother and father’s account

- PMVVY – 15 Lakhs each in mother and father’s account

- NPS – Since there is no limit on this, Ravi invests the remaining 40 Lakhs in NPS Annuity with the plan of spouse getting money on one partner’s death

Considering the above investments, following image shows the monthly pension Ravi’s parents will get.

Ravi is happy that instead of 40K requirement, he is able to generate 60K of pension per month. He assumes that the annual savings of 2.45 LPA will be enough to cover his parents’ vacations and inflation.

However, he is shocked when he sees the calculations related to year-wise expenditure when inflation is taken into account.

Notice that after adjusting for inflation, his parents can survive only for 7 years. They will become dependent after that!

Let us revisit these calculations with different corpus amount:

- At 2 Crore retirement corpus – you can survive for 16 years

- At 3 Crore retirement corpus – you can survive for 21 years

- At 4 Crore retirement corpus – you can survive for 25 years

So as you see, even 4 Crore will not help you survive for 30 years.

The scary part is that all these are based on assumption that interest rates on SCSS/PMVVY will be 7.4% for the entire 30 years. In case the interest rates reduce (or inflation increase), you will be in further trouble.

The situation becomes worse for those who do not have adequate health insurance in their retirement period.

Also Read: Why NOT to rely on Office/Personal Health Insurance for Covid-19

So what is the solution?

We offer you five solutions. Choose one based on your preference.

- Solution 1 – Save more and build a higher retirement corpus (difficult for most financially illiterate people)

- Solution 2 – Change your lifestyle and reduce expenses during retirement years. (won’t help much as you can reduce expenses only to a certain extent)

- Solution 3 – Depend on your children for support (no one wants to do that now)

- Solution 4 – Another option is to invest in places that will give you higher returns so as to beat inflation. In today’s scenario, only equity markets will give you higher returns. So you will have to expose some percentage of your retirement corpus to the equity market. Research carefully and invest only in large-cap companies with strong fundamentals. (practical)

- Solution 5 – The last option is to build an alternate source of income. So use your retirement time to pursue your hobby and try making money from it. (tough but will help you lead comfortable retirement).

Also Read: 17 Simple ways to save money (over 1 Lakh rupees per year)

Happy planning for retirement!

That’s good.. Informative..

Good insight 👍

Good content. I think after some years(people retiring after 20 years from now) 4 crores also would not be sufficient.